What is a Morning Star? An In-Depth Look at This Reversal Pattern.

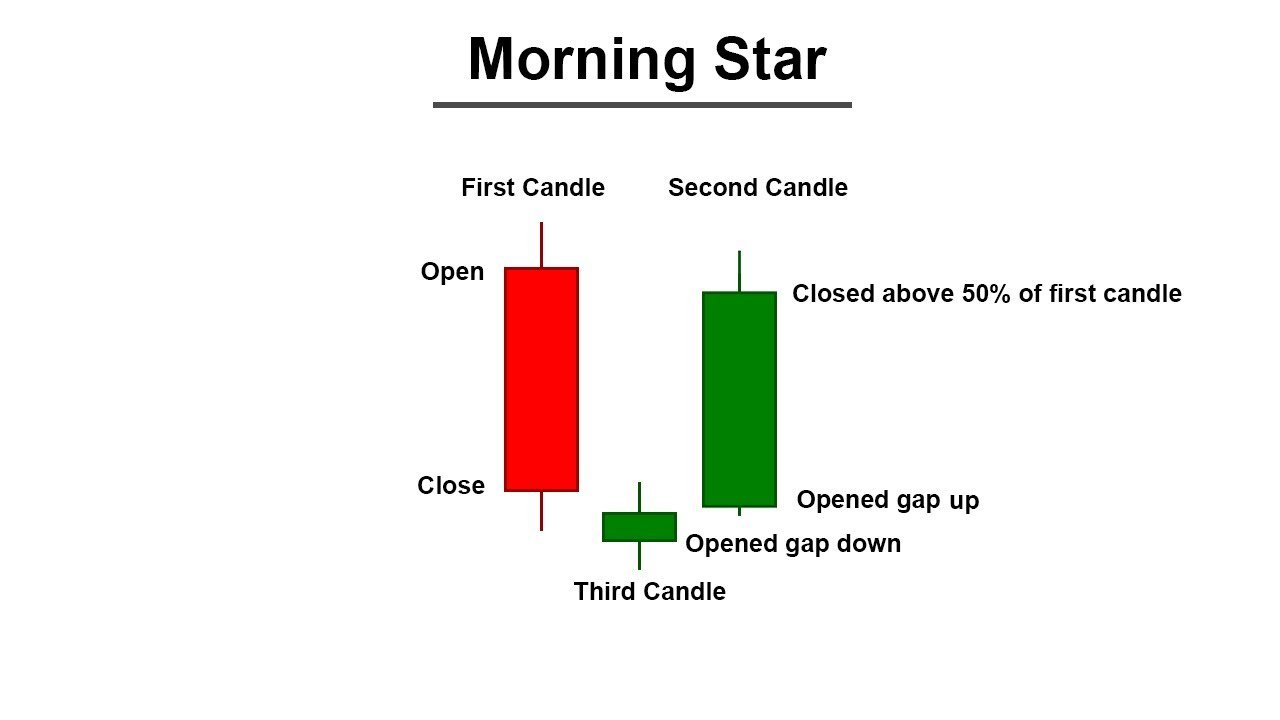

/Candlestick patterns are one of the oldest and most reliable tools for traders. They provide a visual representation of how prices change over time, and can help traders identify potential reversals in the market. One of the most commonly used reversal patterns is the morning star, which is made up of three candles - a tall black candle, a small black or white candle with long wicks, and then a third tall white candle. This pattern captures a moment of indecision in the market where the bears are beginning to give way to bulls and confirms that a reversal has begun. The opposite pattern to this is known as an evening star and signals the start of an uptrend into a downtrend.

How To Read A Morning Star Pattern?

The morning star pattern represents an upcoming bullish trend, which means that it’s time to buy or go long on stocks if you interpret this pattern correctly. The first candle should be a strong bearish candle that indicates that there is currently strong downward pressure on prices. The second candle should have either a small body (either black or white) with long upper and lower wicks indicating that buyers are starting to emerge despite the bearish pressure from sellers during the first period. Finally, the third candle should be bullish with little or no upper wick indicating that buyers were successful in pushing prices higher despite some initial resistance from sellers.

When looking at candlestick patterns it’s important to pay attention to volume as well as price movements since both can give you insight into what’s happening in the market. Volume should increase during periods when there’s more buying activity (which happens during bullish trends). If you see decreasing volume when examining your charts then this could indicate that there isn’t enough buying activity occurring for prices to continue their upward movement, which could signal an upcoming reversal in trend direction.

Conclusion:

In conclusion, understanding candlestick patterns such as the morning star can give traders valuable insight into potential reversals in the markets. By paying attention to price movements along with volume levels traders can gain an edge when making trading decisions based on these technical analysis tools. While not every reversal will be accurately predicted using these patterns they can still be used as effective guides for anyone looking to make sound investments decisions in today’s volatile markets. For new investors especially, taking some time to understand these concepts can prove extremely beneficial down the road when trying to maximize profits and minimize losses based on their decisions about when and where to enter positions in any given security or asset class.